23+ reverse mortgage rules

Because of this the reverse mortgage age requirement is 62 or. Reverse mortgages were meant to help seniors in or nearing retirement.

Reverse Mortgage Age Requirements For 2023

You must be 62 or older to qualify for a reverse mortgage.

. Mortgage Loans for Retirees and Seniors. You are fully responsible for. Ad Compare the Best Reverse Mortgage Lenders.

Ad Calculate Fees and Rates for Reverse Mortgages. Looking For Reverse Mortgage. Get A Free Information Kit.

Web Age Requirements. Looking For Reverse Mortgage Scheme. Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage.

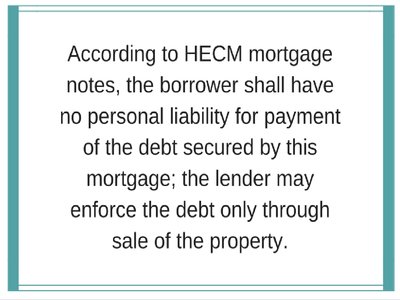

For Home Equity Conversion Mortgage. Ad If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web Official interpretation of 23 f Exempt Transactions Show 1 A residential mortgage transaction.

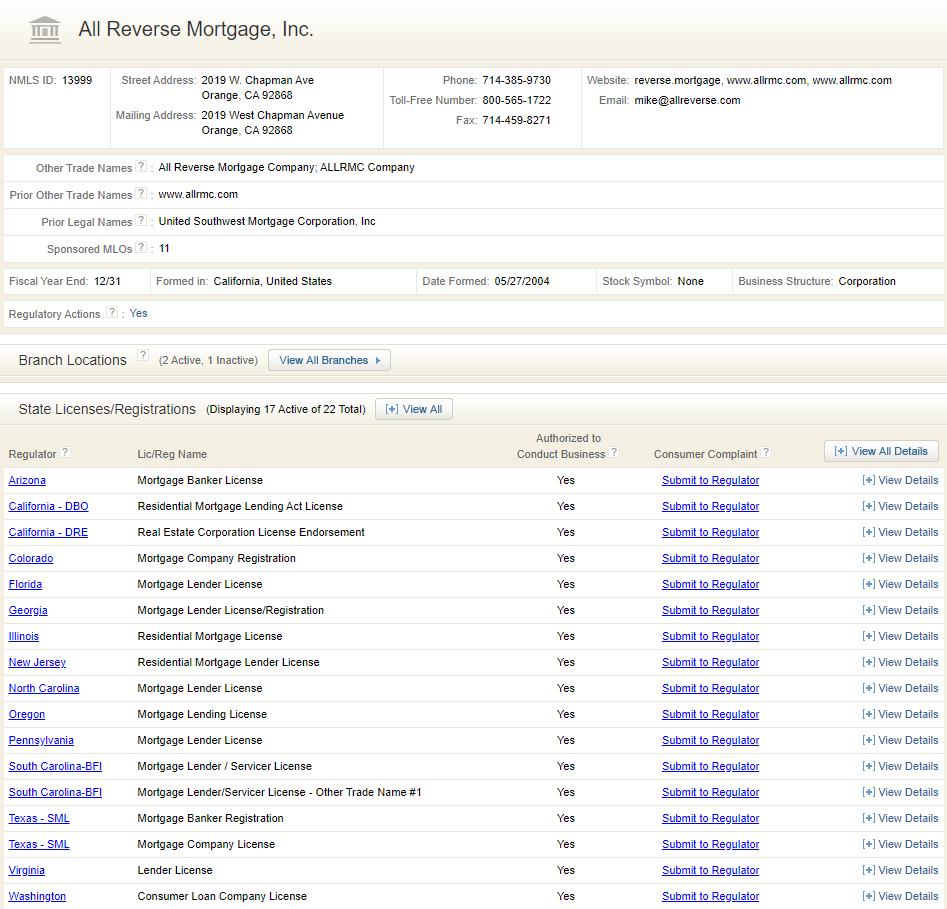

Web 2 days agoMeadowbrook a multi-channel lender offering reverse mortgages has failed to convince a federal judge in Pennsylvania that a proposed class in a class-action suit. Search Now On AllinsightsNet. Web In order to qualify for a reverse mortgage one or more of the homeowners must be at least 62 years of age or older at the time of closing.

You must have significant equity in your home. For Homeowners Age 61. For Homeowners Age 61.

Ad Compare a Reverse Mortgage with Traditional Home Equity Loans. 2 A refinancing or consolidation by the same creditor of an extension of. For Homeowners Age 61.

Web Generally a reverse mortgage must be paid back when you die or move from the home. Get A Free Information Kit. Benefits Of Reverse Mortgages and Find Out If You Qualify.

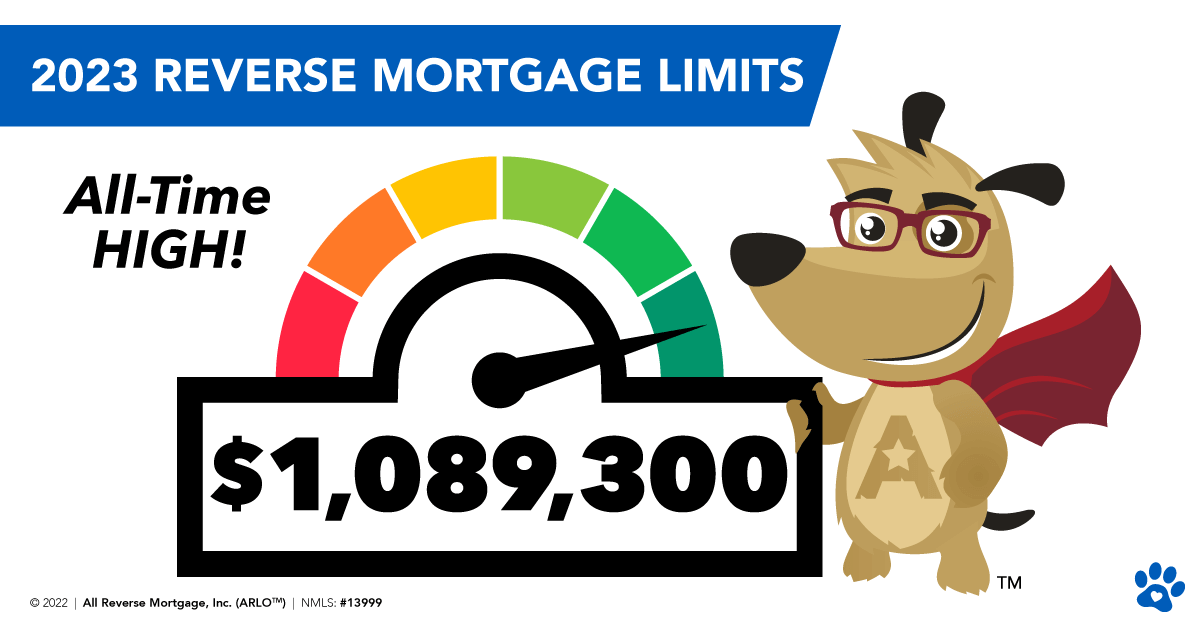

Web Under these new HUD reverse mortgage changes borrowers can make a maximum claim amount of 765600 for the 2020 calendar year raising it more than. Ad An Overview Of Reverse Mortgage And How It Works. Web The National Reverse Mortgage Lenders Association NRMLA moved to make it an ethics violations to refinance existing reverse mortgages with less than 18.

You could use up your equity so you get nothing when you or your estate eventually. Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. You must live in the house.

Web Most reverse mortgage loans are Home Equity Conversion Mortgages HECMs. While age requirements vary by loan program all reverse mortgage borrowers must meet an age requirement. Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

A HECM must be paid off when the last surviving borrower or Eligible Non. How to Qualify for a. Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

The most common way to repay a reverse mortgage is to sell the home and use the proceeds to pay back the loan. Ad Compare the Best Reverse Mortgage Lenders. Web Top Ten Reverse Mortgage Facts.

For Homeowners Age 61. Ad Should You Get A Reverse Mortgage On Your Property.

2023 Reverse Mortgage Limits Reach All Time High 1 089 300

![]()

2023 Reverse Mortgage Lending Limits Remain High

2021 Reverse Mortgage Limits Soar To 822 375

Housing In Ten Words The Baseline Scenario

Pdf The Public Value Of Social Housing A Longitudinal Analysis Of The Relationship Between Housing And Life Chances

Pdf Transnational Higher Education In Asia And The Pacific Region Futao Huang Academia Edu

Law Democracy And Governance Syllabus 2016 Pdf Governance Development Economics

5 Rules That Apply To Reverse Mortgages In 2023

The Role Of The Federal Housing Administration In The Reverse Mortgage Market Congressional Budget Office

What Is A Reverse Mortgage Loan Everything You Need To Know About It

Bootcamp008 Project F Txt At Master Nycdatasci Bootcamp008 Project Github

April 2021 By Flagstaff Business News Issuu

2023 Reverse Mortgage Lending Limits Retirement Living

Reverse Mortgage Basics Just Ask Arlo

424b4

مؤسسة بنيان التنموية موقع ووردبريس عربي آخر

The Hidden Perks Of Taking A Reverse Mortgage Loan